How to collect debt from a friend

One of the most common issues we come across is when a debt is owed to our client by a friend who uses their services. Below we outline the most common scenarios that occur and what you can do to collect debt from a friend without the “awkwardness”.

Let’s say your friend decides to purchase one of your services or products. You agree a fee and you provide your service or product. However, because you trust them you don’t follow your usual procedure in the same way you usually do when you obtain a new customer.

Perhaps you didn’t tell them how and when you expect to be paid? Or maybe you didn’t send an invoice like you normally would?

Your friend has previously paid you on time and you think they have a great reputation and enough money to settle their bills.

But what happens when:

- They run into cash flow problems and think that you can wait for your money over their other suppliers?

- They cancel your service and expect not to have to pay you because you are friends?

Many people fail to follow their normal company procedures when doing business with friends.

Perhaps you didn’t:

- Obtain your friends business address, invoice address or any additional channels to communicate.

- Issue a contract or your “terms of business.”

- Credit Check your friend or their business because you trusted it will be ok, “they will pay” you say.

- Send your official terms of payment because it felt awkward. You didn’t want them to think that you “don’t trust them!”

So what about when it all goes wrong?

- Your friend now owes you money.

- Now you feel awkward asking for your payment because you don’t want to ruin your relationship with them.

- You “don’t want to sound desperate”.

So, what can you do to collect your money?

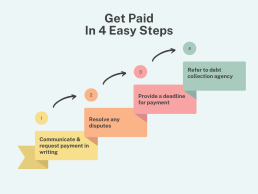

We advise to begin by communicating with them. Simply asking for a payment owed to you or your business should not feel “awkward”. When you take away the emotion from this transaction, it is a simple request for a payment to be made for a service you have provided.

When you don’t have their full details, start with the communication method you do have. If that’s a contact number, call them. If you only have their email address, email them, and provide a simple request for payment.

Try to contact your friend and resolve any dispute they may have. Speak to them openly and professionally. Where there may be a dispute, do request their address or email so that you can follow up with everything said formally in writing.

If they don’t answer your calls, or respond to your emails, you should begin a formal debt recovery process. Perhaps you can let them know politely that this is your company policy and if their fail to pay you (by a given deadline), then you could write to them with the following:

“Although this is not something I wish to do, it is with regret that I will be passing the debt over to our debt collection partners to recover the outstanding balance”.

Always put your requests for payment in writing too.

Payment Plan or Settlement Agreements

If you are aware that your friend has ‘limited funds’ or has fallen into hardship, perhaps consider offering them a reduced settlement agreement or a formal payment plan. A reduced settlement agreement should ideally be for a limited time only, so make sure you let them know the date and time the offer expires.

A formal payment plan, if you can agree one, should be documented in writing. For example, “you agree to pay £100, starting tomorrow (date), and thereafter each week until the debt is settled in full.”

Debt Collection Partner

Alternatively, if the situation has become too challenging or stressful you can always instruct a third-party debt collection company to start the debt collection process for you.

Often, when a company or person receives a Debt Collection Letter from a reputable company they will pay.

Contact a member of our team confidentially today and let’s discuss how we can help you.

Although this may not help you right now with collecting the outstanding payment owed to you, going forwards we advise:

When you do business with a friend or acquaintance, you should treat this as any other business transaction. You should always obtain their full details, including their address, company name, registration number.

Always discuss your payment terms and send an invoice to them.

Issue all customers with your official terms and conditions. If they question you, tell them “It’s just company policy and standard procedure.”

Any normal friend will think you are professional and will recommend you, your services or product to others when they see how professionally you work.

Following the above steps may save your friendship and help you get paid on time in the long term.