The Benefits of Having a Strong Credit Management Policy

A credit management policy defines and lays out your rules and steps to reduce business risk. In short, your credit management policy maximises your company revenue while minimising the risk generated by extending credit or payment terms to your customers.

For all businesses who do not request payment in advance or on order, a credit management policy is a must.

Effective Credit Management serves to prevent late payment or non-payment.

Research undertaken by online bank Tide discovered that UK SMEs are chasing more than £50bn in late payments.

To understand how businesses can prevent becoming part of that statistic, it is vital for any business to have a strong credit management policy in place. Doing so ensures your staff and customers understand the processes and necessary actions required, which ultimately will ensure a healthy cash flow whilst reducing business risk.

Healthy cash-flow starts with the customer on-boarding process.

For staff:

For clients:

It is important to remember that as processes change and become more defined, you should keep your policy updated. Business documents, be it a mission statement, business plan or policy are only worthwhile if they are kept up to date.

When writing a credit management policy for your business, consider the steps below:

-

Establish internal processes/roles/responsibilities

- Be clear of all steps involved and who is responsible. This could also include communication methods, ie how you allow employees to communicate with customers and what steps to take when a customer fails to pay.

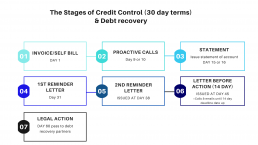

- For example – will you send 2 reminder letters, a final notice and then send to your debt recovery partner?

- Will you immediately send a letter before action when an invoice is a day overdue?

The point is that your team or employees have a process to follow. Having a credit policy provides members of staff with something to fall back on when a customer maybe a long standing one! The member of staff is performing their duties in accordance with your clearly defined credit management policy!

Describe your credit checking process

- Explain which service you use to credit check your customers and how often you perform credit checks.

- Explain the steps you will take when you notice a customers credit limit has suddenly dropped.

Put terms and conditions in place for payment

-

- T&Cs can include payment terms (up front, on receipt of goods/service or set number of days) as well as any late payment penalties.

Client by client, agree credit limits

-

- Offering credit terms helps to build strong business relationships. However, do let your customer know that you will apply Late Payment Fees and Interest in accordance with the Late Payment of Commercial Debts Interest Act 1998 should they fail to pay.

Outline client payment methods

-

- Understanding how each client will be paying you can help you monitor cashflow. Will they be paying by bank transfer, standing order or direct debit?

- Don’t forget, they more payment methods you have available for customers to pay, the easier it is for them to do so without excuse.

The benefit of having a strong credit management policy is that it will make credit control more effective, it will improve cash-flow and it will reduce business risk.

To understand why credit control is an essential role for your business, take time to read our article here.

How we can help

Talk to us at FJCM to understand in greater detail how we can work together to support your business.

Obtain your free credit management policy review today.